Paid partnership with Manhattan Associates

What do you call a retailer with a relentless drive to enhance the customer experience? This may sound like the start of a geeky retail joke but it’s a serious question. We used to brand these more nimble businesses as “disruptors”. They were the ones ripping up the rulebook, defying the status quo and continuously elevating the shopper experience.

Today, I’d argue that all retailers need to adopt a mentality of perpetual disruption. In the fast-moving world of retail, today’s innovations quickly become tomorrow’s norms. You’ve got to keep evolving and experimenting. Failing fast has become a prerequisite.

This was evidenced in a new study from Manhattan Associates. The inaugural Unified Commerce Benchmark for Specialty Retail in Europe assessed 50 retailers across three verticals (apparel and footwear, home and DIY, luxury) in five European markets (France, Germany, Italy, UK, the Netherlands).

Retailers were categorised as Leaders, Challengers, Followers and Laggards. The study then revealed common attributes of successful retailers across four categories: Search and Discovery; Cart and Checkout; Promising and Fulfilment; Service and Support. So what have we learned?

Firstly, the study called out four participating retailers as true leaders in Unified Commerce: Adidas, H&M, Leroy Merlin and M&S. These businesses aren’t just ticking boxes by offering capabilities such as real-time inventory statistics and product recommendation tools; they are actively embracing technologies that enable them to deliver more nuanced, and increasingly personalised, customer experiences.

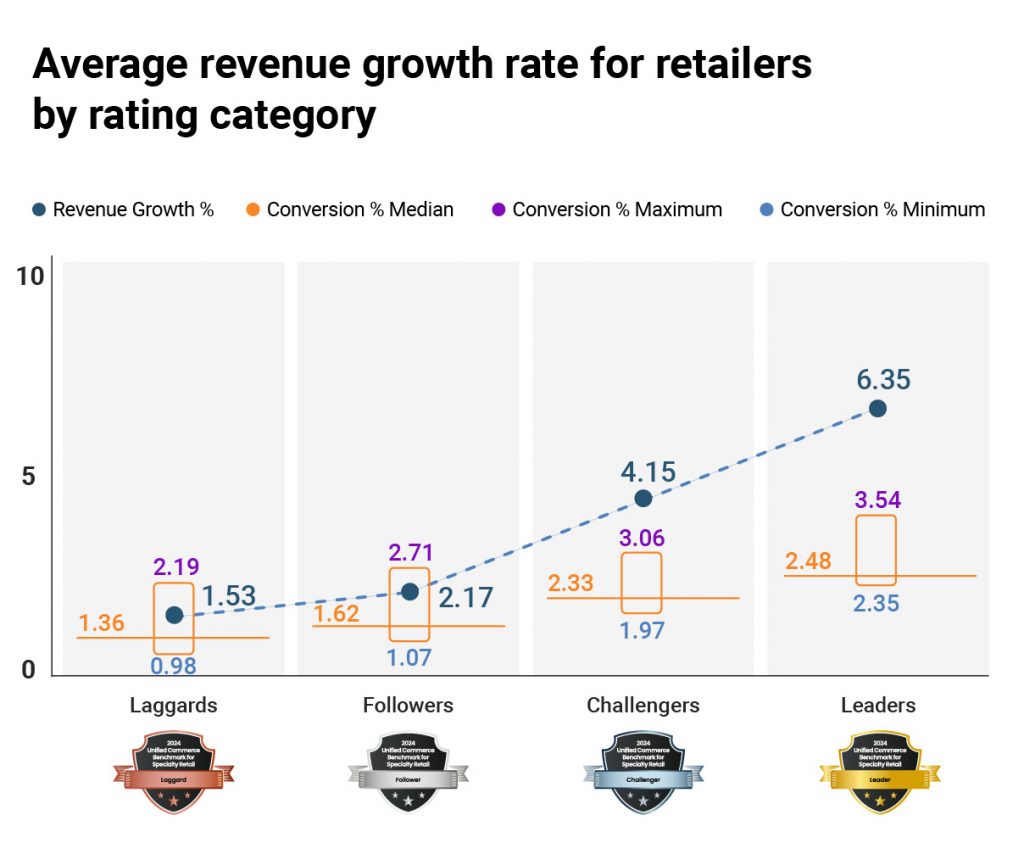

And it’s paying off. The study found that Unified Commerce leaders’ revenue growth outperforms non-leaders by at least twofold.

Guided Inspiration, Rich Findability and Immersive StoryTelling

Leaders in ‘Search and Discovery’ help shoppers discover meaningful products, whether they are looking to fulfil an immediate need or are looking for inspiration. Most leaders in this space already bundle product offerings (offer suggestions to ‘buy the look’ or ‘buy the set’), and I imagine this will become the norm in the very near future as more retailers embrace the power of AI.

There is always room for improvement and Manhattan specifically calls out capabilities like offering real-time visibility on product description pages (PDP), inventory status callouts for low/out-of-stock items, and personalised recommendations on home page. Retailers should also strive for greater visibility of delivery times, for example by allowing shoppers to filter by fulfilment method.

Most leaders offer back-in-stock notifications and 100% of them provide product sourcing information and detailed content on sustainability practices. This is an important point – retailers must go beyond product features and really immerse the shopper in the brand’s ethos. Transparency is going to be key going forward.

Unified Basket, Payment Flexibility, Frictionless Checkout

The biggest point of friction in today’s retail customer experience is due to the loss of context when transiting between the physical and the digital. Those retailers leading the way in ‘Cart and Checkout’ understand that a unified cart or basket is a foundational capability when it comes to that all-important connection across channels: 40% of leaders show personalised promotions and offers on PDPs and cart, compared to 6% of non-leaders. Most leaders also allow shoppers to view promo codes in cart and check product availability status by store in cart.

Given the proliferation of payment options today, most leaders also offer checkout with buy now, pay later (100%), Apple Pay or PayPal (70%), as well as the ability to use mixed payment methods for the same order (40%).

In-store and online cart abandonment is still far too regular of an occurrence in retail. In fact, more than one-third (35%) of shoppers said that they abandon their shopping cart because of lengthy checkout process and a whopping 37% said they will not retry if asked to re-enter payment or delivery details. It’s essential that retailers provide seamless checkout experiences that reduce unnecessary friction at the point of conversion.

Flawless Fulfilment

I’ve often said that the post-purchase experience tends to be more of an afterthought than a strategic priority. Well, that is finally changing as retailers recognise that a shopper’s product pick-up or delivery experience must be as seamless as their shopping journey. Not only do leaders in ‘Promising and Fulfilment’ make sure retailers meet or beat their delivery promises consistently, they do also so while being more environmentally friendly too.

Offering shoppers greater post-order flexibility, including complete or partial cancellations, and greater delivery/pick-up options are all areas leaders excel in. Sixty percent of leaders offer shoppers the ability to cancel orders post-purchase compared to 28% of non-leaders.

And shoppers are crying out for this: more than two-thirds of shoppers want a self-service option to be able to edit order after placing them. Meanwhile, nearly three quarters (73%) of shoppers value expedited deliver (same business day) but are only willing to pay less than €5 for the service.

Manhattan calls out the ability to highlight the carbon footprint / impact of fulfilment choice as an area for improvement. Shoppers are hyper-informed when it comes to pricing and product information, but too often they are fumbling in the dark when it comes to sustainability. I believe this will change considerably over the next decade and retailers must prioritise transparency to drive greener purchasing decisions.

360 Degree Service

Leaders in the ‘Service and Support’ segment offer shoppers a wide variety of service options from call centres to in-store assistance, social media support and live agents available via their website and mobile app. What is most important, however, isn’t the breadth of support options but the fact that they offer seamless continuity, consistent quality and always-on availability.

Leaders empower shoppers to self-serve most of their needs. Nearly all (92%) offer support on order modifications, returns and exchanges via chat/call and 75% offer their customers the ability to return purchases to drop-off locations.

In addition to problem solving, leaders also offer value-added services such as customisations, style/fit guidance and in-store hospitality to turn service interactions into a secret sauce of brand stickiness. Most leaders empower their store associates to check a shopper’s online purchase history while in-store (75% compared to 48% of non-leaders). They should also be striving for in-store appointment scheduling via their digital channels, product personalisation and allowing store associates to create or manage a shopper’s wishlist.

As I have said on numerous occasions, we are witnessing a democratisation of white-glove service within the retail industry. Don’t get left behind.

Download the full report.