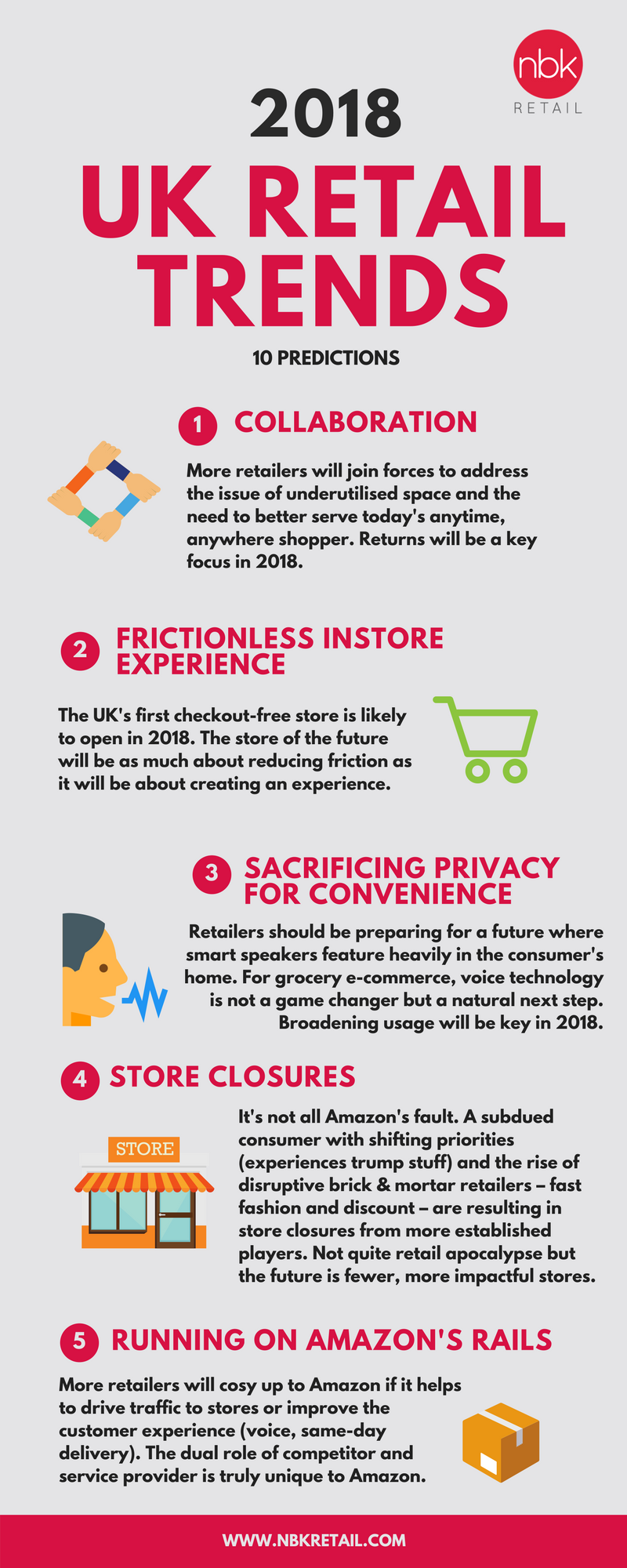

‘Permacrisis’ was declared the word of 2022, so what might 2023 bring?

There are reasons for cautious optimism, but first retailers are going to have to buckle up and brace themselves for more turbulence.

Spending more to buy less

Let’s briefly recap on retail’s Golden Quarter. Christmas was not the wipe-out that many of us had expected. After a bumpy couple of years with Covid cancelling Christmas, consumers were determined not to let illness, inflationary pressures or industrial action hamper their celebrations.

There are some caveats here: soft comparatives (remember Omicron?); supermarket success came at the expense of the hospitality sector; and perhaps most importantly much of the growth we saw was fuelled by inflation – in December retail sales were up in value terms but volumes continued to fall. In other words, consumers are spending more to buy less.

Inflation might be starting to ease, but consumers are still a long way from feeling the benefit. This ongoing erosion of spending power makes for a pretty gloomy outlook: consumer confidence tanked again in January, returning to a near 50-year low. Looking ahead, the deterioration in consumer sentiment is likely to persist throughout the first half of the year, at least. A reminder to retailers that value will remain firmly top of mind, purchases will continue to be incredibly considered, and big-ticket discretionary buys will be delayed.

Trimming the fat

The spending hangover is here and while there’s never a good time for subdued consumer demand, it’s especially painful when retailers are simultaneously grappling with their own cost inflation. No one is immune: this dangerous combination of soft demand and rising costs is impacting even the most bulletproof retailers. Amazon, for example, is laying off 6% of its global workforce, closing warehouses and putting the brakes on bricks & mortar expansion. 2023 will be a year of operational efficiencies for retailers, in many ways mirroring their own customers’ behaviour by trying to do more with less.

The other immediate challenge for retailers will be shifting excess stock, the result of over-ordering during the supply chain crisis and exacerbated by the current consumer weakness. With a glut of inventory and sluggish demand, retailers are left with little choice but to slash prices. But wait, haven’t they been doing that for the past four months? Aside from the obvious margin implications here, there is also the risk that shoppers are becoming desensitised as promotion fatigue sets in – or even worse, that they forget what it’s like to buy at full price.

2023 opportunities: bricks & mortar resurgence and immersive digital experiences

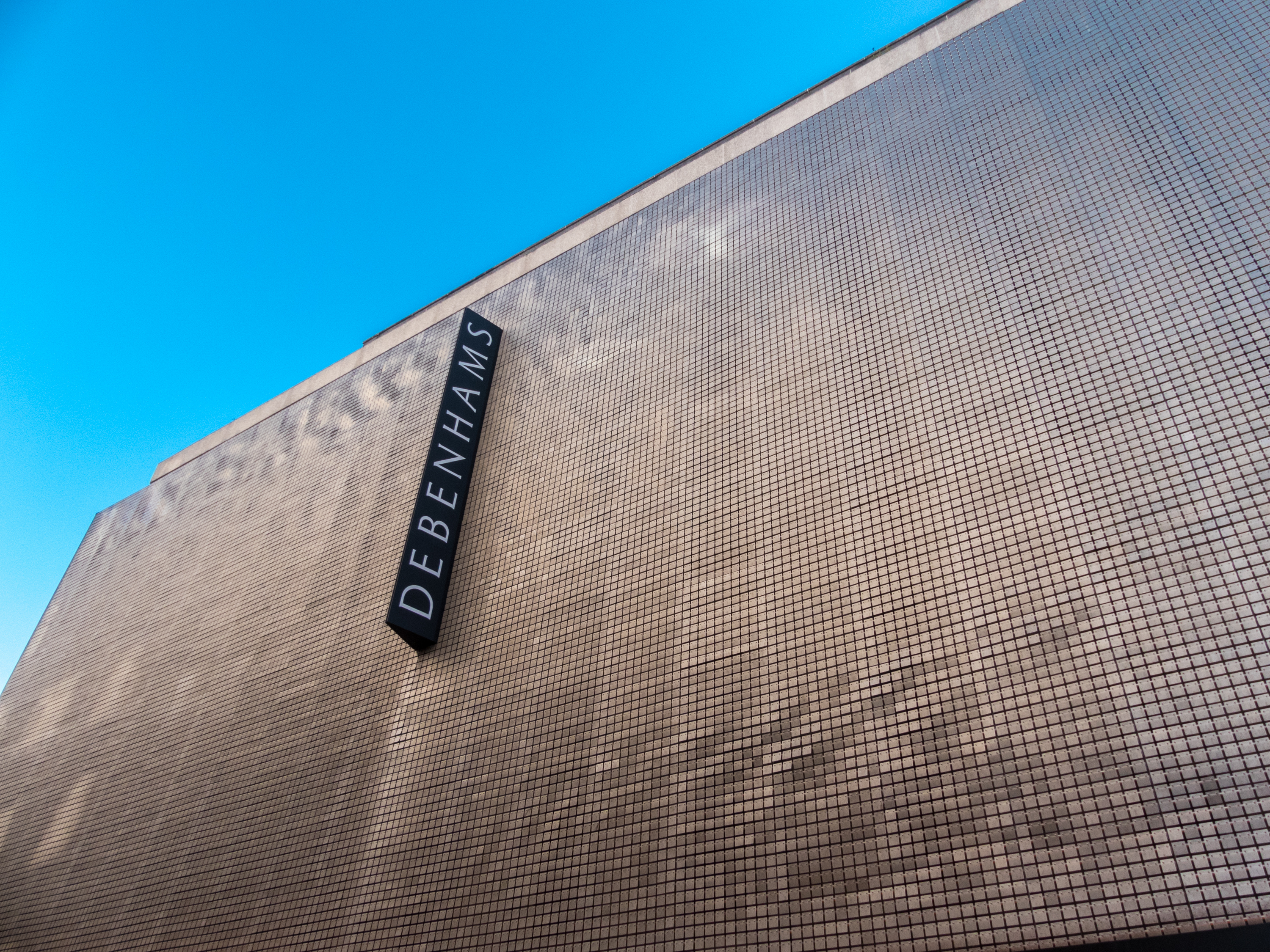

There’s no sugarcoating it: 2023 is going to be another year of instability and uncertainty. But the retail industry is nothing if not resilient and I believe there are reasons to be optimistic. Stores are back, they’re repurposed and better than ever. We’ve been thrust into the future thanks to the pandemic-induced digitization of bricks & mortar retail, levelling the playing field and shifting the industry’s perception. Stores were once considered liabilities in this digital era, but they’ve been reconfigured for 21st century shopping and are now essential assets.

When it comes to customer experience, I believe that ‘tech-enabled human touch’ will be the next battleground, as retailers recognise the many opportunities that come with equipping your staff with the right digital tools. Mediocre experiences have become a thing of the past. Meanwhile, automation will climb higher up the agenda as retailers look to achieve operational efficiencies, despite the initial outlay, while simultaneously addressing the current labour shortage. In 2023, we’ll see more trials of autonomous vehicles delivering our goods and robots working alongside humans in warehouses.

Shoppers will continue to abandon e-commerce in droves now that we have returned to some semblance of normality. Some categories like food, fashion and furniture will never transition online like the rest of retail has, but it’s clear that as an industry we have been propelled towards a more digital world. And over the next decade, new, immersive digital experiences will redefine our perception of e-commerce – this is going to be the next big thing in retail. I’m still a bit of a metaverse sceptic. I know barriers can be knocked down but right now how many of us really have a VR headset kicking around at home? However, it’s clear that e-commerce is ready to evolve. Sure, all of the friction has been sucked out and today the experience is wildly accessible, slick, effortless. But is it any fun? Not really. It’s still far too transactional, too one-dimensional. This will change.

The next stage of e-commerce is all about immersion, discovery, curation, hyper-personalisation and escapism. And it’s already happening with augmented reality, virtual showrooms, live shopping, social commerce, 3D product views/virtual try-ons, video shopping consultations, among others. In the future, we won’t know where the physical world ends and the digital one begins.

Our hybrid way of living is here to stay and while businesses may still be acclimatising to the consequent shifts in demand patterns, longer term this will present new and exciting customer engagement opportunities. Despite tight budgets, investment in sustainability will remain high on the agenda in 2023, while opportunities to tackle the often-neglected post-purchase experience and explore new revenue streams such as retail media and third-party marketplaces will accelerate. In summary, short-term volatility will persist while consumers batten down the hatches, but as always the future of retail is bright for those who are willing to evolve.

n reinvention and rightsizing – they see potential for at least 30 stores to be downsized, in a similar vein to competitors like M&S and House of Fraser.

n reinvention and rightsizing – they see potential for at least 30 stores to be downsized, in a similar vein to competitors like M&S and House of Fraser.