Paid partnership with Manhattan Associates

The most successful consumer-facing businesses today are those that uncover their customers’ needs first and then work backwards to provide the right experience. In theory, customer experience should have always been at the heart of retailers’ strategies from day one. After all, the whole point of retail is to serve the customer. But, let’s face it, for a long time, retailers were able to dictate the terms.

As Eddie Capel, CEO of Manhattan Associates, told me at the Manhattan Exchange in Berlin last month: “We got used to a no culture. Do you have my size? No. When might it be back in stock? Dunno. There was a lot of no in retail for a long time. Retail has turned into a ‘yes culture’.”

But what sparked that change? I was intrigued to hear his thoughts because this formed the very foundation of my and Miya Knights’ Amazon book, so I naturally had a few ideas of my own on the topic.

“Retailers did not have to worry about loyalty, but that has changed immensely now. Creating a ‘yes culture’ has become key, and Amazon and others have pushed retailers on service and delivery promises. Technology is helping to keep those promises,” Capel added.

I couldn’t agree more. As customers today, our tolerance for mediocrity is pretty low. We expect to shop on our terms. We no longer accept bland, vanilla retail experiences. Instead, we want the red carpet rolled out for us. We want a white-glove experience. We want to be wowed, surprised and delighted.

Retailers have made significant progress in blending the physical and digital worlds, but there is still more to do. In the whitepaper that I authored for Manhattan Associates, we found that just 6% of retailers that we surveyed have an accurate view of their inventory across their entire business 100% of the time. I have to admit, that figure shocked me given that we are living in this on-demand era where customers are hyper-informed and, in Capel’s words, retailers need to be “promise keepers”. How seamless of an experience can you offer if you don’t consistently know where your stock is?

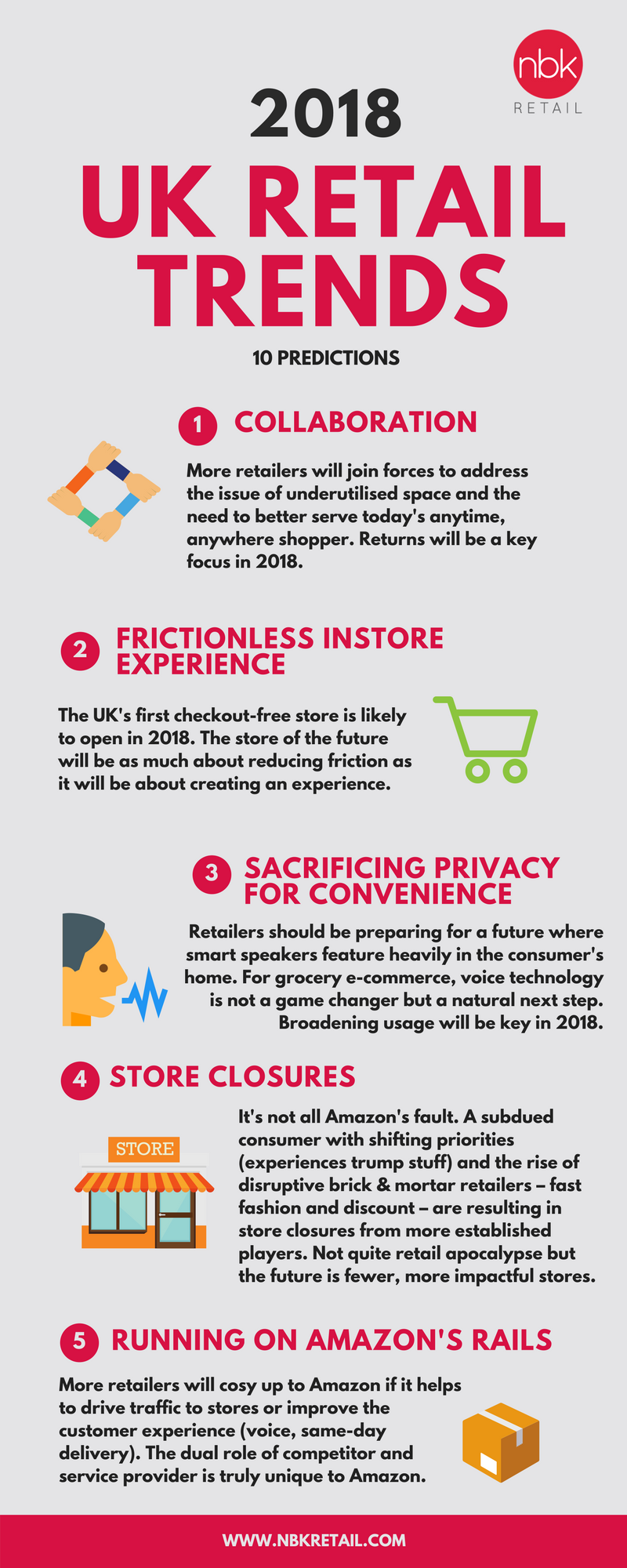

Another area where I see room for improvement – and this was reaffirmed by the report – is returns. Even today, the post-purchase experience is often neglected. For example, only around half of retailers we spoke to allow customers to buy online and return in-store (46%) or buy in-store and return online (50%).

Enabling this level of flexibility and cohesion will enhance the experience for the customer, but more needs to be done to stamp out returns from happening in the first place. The industry needs to collectively address its perennial problem. In recent years, retailers themselves have exacerbated this problem in an attempt to appease the customer – offering free returns and encouraging a buy-to-try mentality.

There is some progress being made, for example around sizing/fit among fashion retailers. Some have even gone to the extreme of charging for returns, very much uncharted territory for a sector where over one-third of purchases are returned. And let’s not forget, as counter intuitive as it may seem, those big returners are often a retailer’s most valuable customers.

But it’s better for all parties to get it right in the first instance. Looking across the wider retail industry, another way to reduce the rate of returns is by giving customers greater control over fulfilment. As things currently stand, all control is lost once the customer places an order. If they want to change their delivery or edit their basket, it’s simply too late. It then becomes a return.

Giving customers more control post-purchase doesn’t just translate to a better customer experience – which ultimately drives greater loyalty – but it also has both economic and environmental benefits. Brian Kinsella, SVP, Product Management argues that customers should be granted a window in which they could change their mind on fulfilment method, for example switching from home delivery to click & collect and vice versa. Kinsella even believes that shoppers should be able to cancel an online order. Why? To drive down returns, or what he calls “unnecessary shipments”.

In Berlin, Kinsella also called out the importance of communication post-purchase. More retailers, for example, should be utilising real-time messaging with home delivery, again to simultaneously improve the experience for the customer while ensuring someone is in to receive the delivery.

Historically, retailers may have begrudged looking beyond immediate customer needs, but today it’s imperative that retailers proactively address pain points. They need to be continuously re-evaluating the customer journey, identifying and removing any new points of friction and ensuring that they are going above and beyond. The risk of inaction is simply too great.