I’m so excited to launch, in partnership with retail technology leader Red Ant, the first of a three-part series of whitepapers to explore how the retail industry will have to embrace the digital store and seamless shopping to survive, from frictionless checkout to hyper-personalisation and clienteling. There’s no doubt that the industry has undergone seismic change in the last few years, and it’s not over yet.

Why the store is not dead

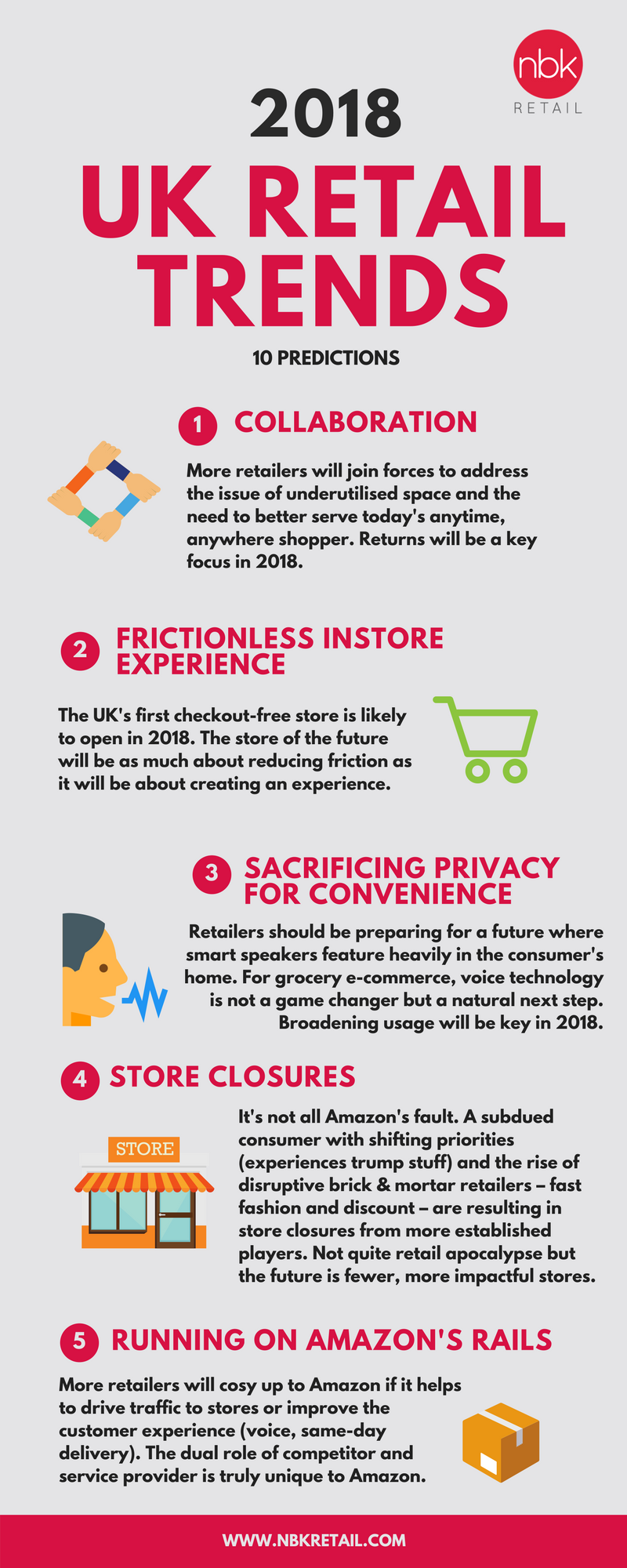

Over the past decade, we’ve witnessed the birth of the ‘on-my-terms’ shopper and the seemingly unstoppable rise of e-commerce. Today’s ubiquitously connected shoppers are firmly in the driving seat, and retailers are scrambling to keep up with dramatic shifts in both customer behaviour and expectations.

It’s clear that not all retailers have been equipped to deal with the accelerated pace of change facing the industry. As such, we’ve seen high-profile casualties on the high street as well as record numbers of job losses and store closures. And we should be bracing ourselves for more short-term pain as the industry reconfigures for the digital age. Although it’s not quite a retail apocalypse, there are a couple of important points that we must acknowledge:

- We have an oversupply of retail space. According to the Office for National Statistics, online sales accounted for less than 5% of UK retail sales in 2009. Fast forward to 2019 – a whopping 20% of retail sales now take place online. Although e-commerce shouldn’t be viewed as the death knell for the high street, retailers must streamline their store portfolios to better reflect consumer demand. The future is fewer, more impactful stores.

- There is no room for mediocre retail. In today’s climate, you have to be on top of your game. The retailers that are struggling right now share some common traits – they lack agility, differentiation, relevance. They try to be all things to all people. They don’t have a compelling purpose. And having an iconic brand doesn’t make you immune to the broader challenges facing the high street. This is retail Darwinisim – put simply, you evolve or die. But, for those brands willing to adapt, this is a fantastically exciting time to be in retail.

Stores will undoubtedly continue to play a critical role in retail for decades to come, but, in a nutshell, customers will expect to shop on their terms, not the terms dictated to them by the retailer. This means that high street retailers need to ensure they’re saving customers’ time or enhancing it. There is no longer a middle ground. We believe that stores of the future will be:

- Frictionless – to keep up with online retail

- Experiential – to distance themselves from online retail

- A hub for fulfilment – to bridge the gap between online and offline worlds

Those retailers who use the right digital platform to transform and tailor in-store experiences will be able to ensure differentiation from rivals and relevance to customers.

Download Store of the Future: The Digital Store now to get the full picture.

n reinvention and rightsizing – they see potential for at least 30 stores to be downsized, in a similar vein to competitors like M&S and House of Fraser.

n reinvention and rightsizing – they see potential for at least 30 stores to be downsized, in a similar vein to competitors like M&S and House of Fraser.

A decade ago, click & collect was just something Argos did. Today, virtually every high street retailer offers click & collect, as it enables shoppers to marry the benefits of online shopping – assortment and price – with the convenience of collecting instore.

A decade ago, click & collect was just something Argos did. Today, virtually every high street retailer offers click & collect, as it enables shoppers to marry the benefits of online shopping – assortment and price – with the convenience of collecting instore.