Paid partnership with Manhattan Associates

The latest whitepaper from Manhattan Associates, Redefining Retail: What’s Next for Shoppers and Retailers?, has just launched and here’s one of the things that stood out for me – consumers’ deprioritisation of sustainable purchases.

Don’t get me wrong, there still very much appears to be a desire to shop in an environmentally conscious way – but consumers are currently less willing (or able) to pay for it. Of the 6,000 global consumers surveyed by Manhattan Associates, 45% said they still consider sustainability a top or important consideration when choosing where to shop, but this is down slightly on the 50% who agreed with that statement last year.

Persistent economic concerns have curbed consumers’ appetite for sustainable shopping. In the current climate, frugality trumps sustainability. The perception, and at times reality, that green products come at a price premium has led shoppers to abandon their eco credentials to switch to low-cost alternatives.

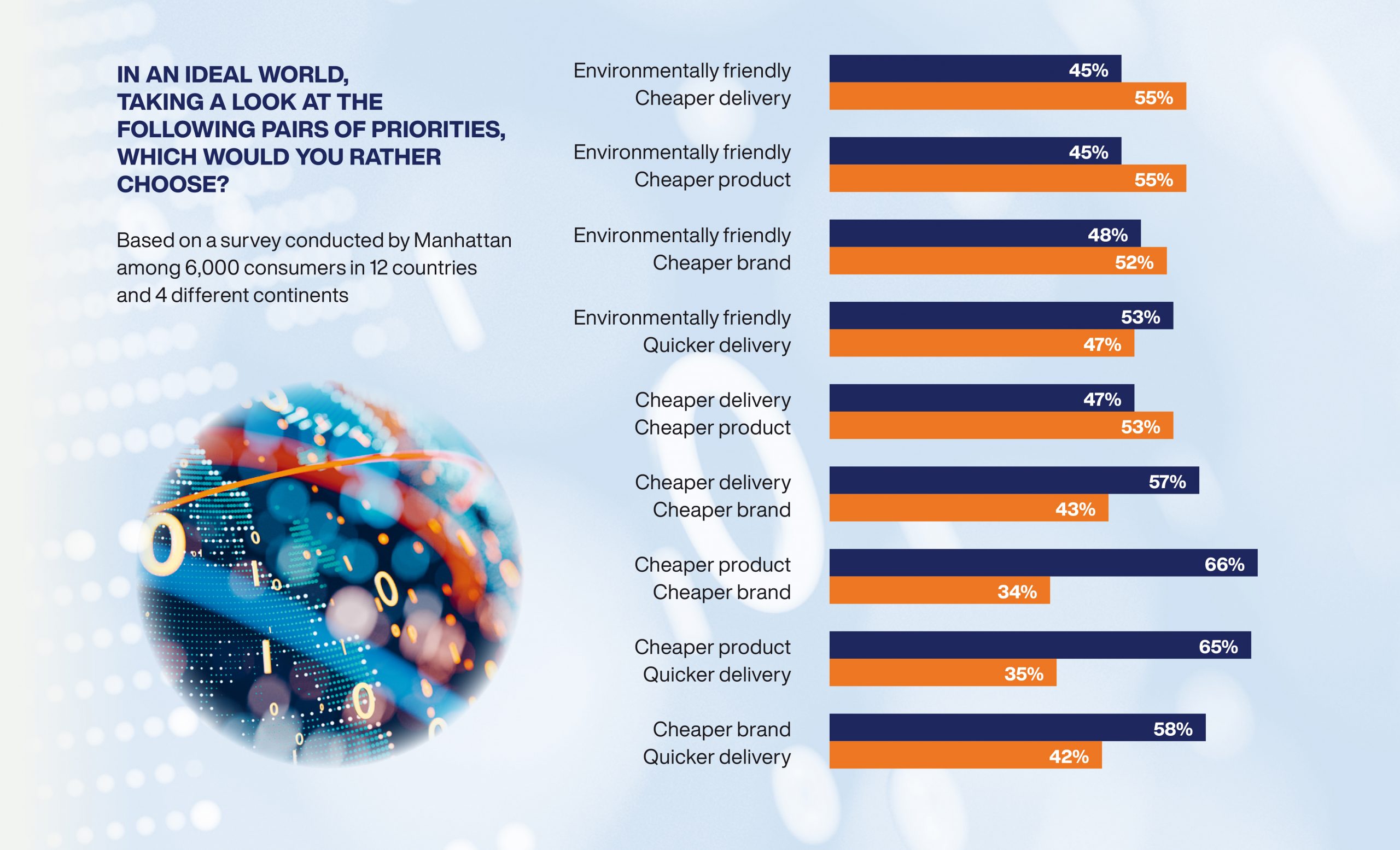

The Manhattan survey presented consumers with pairs of priorities (ie. “cheaper” vs “environmental friendliness” in terms of brand, product and delivery) and asked them to select which they are currently choosing. Unsurprisingly, “cheaper” prevailed the majority of the time.

But challenging financial times do not impact all consumers equally. More mature demographics are likely to be most insulated, with 1 in 5 (20%) consumers aged 65 years and over reporting that there is that the cost-of-living crisis has had no impact at all on their shopping habits. Yet this is the group least likely to take sustainability into consideration when choosing where to shop: over 20% of older shoppers said that sustainability is not important or not at all a consideration for them when selecting a retailer. This contrasts sharply with the 55% of 18-24-year-olds who consider sustainability an essential or important consideration.

So what does this tell retailers? It’s never been more important to know your customer! One size most certainly does not fit all. At a strategic level, retailers need to roll out the red carpet for their most loyal customers and ensure they are living up to their brand values. At an operational level, hyper-localised product assortments and more targeted, real-time promotions will help them to cater to varying customer demands.

The whitepaper also addresses the elephant in the room – the environmental impact of e-commerce deliveries. When consumers were asked about their most important delivery consideration, only 8% cited the impact on the environment. Cost and convenience are naturally going to be top considerations, but I think the lack of transparency and awareness around the carbon impact is also a factor here. The uncomfortable truth is that retailers have spent the past decade training shoppers to expect fast and free delivery, regardless of the financial or environmental cost.

The tide, however, is beginning to turn. Some retailers have quietly started charging for delivery and returns, while others have implemented more sustainable delivery options in a bid to decarbonise the last mile. Reduced packaging for home deliveries and ‘packageless’ collections and returns are starting to gain momentum. And, with many retailers now able to provide near real-time inventory visibility, consumers can make smarter decisions about which stores to visit or which delivery options to choose, which can significantly minimise miles travelled and open up a variety of greener last-mile delivery options.

Retailers are still in the nascent stages of giving customers greater control post-purchase, but this will evolve in the future as retailers recognise the triple benefits – profits, pockets and planet. So what exactly can be done? Offering no-rush/green delivery, letting shoppers select the day of their delivery, encouraging shoppers to consolidate orders and even letting them make basket edits after the transaction. That’s right, in the future, more retailers will allow shoppers to alter online orders right up to the point a shipment leaves the warehouse, store or microfulfilment centre. With these longer ‘order modification’ grace windows, retailers can not only enhance the customer experience but also reduce split-shipments and, in theory, unnecessary returns.

Ultimately, the onus is on the retailer to initiate change. When retailers were asked to select their top 3 business priorities for 12 months, only around 1 in 5 retailers called out creating a more sustainable and environmentally aware supply chain (21%) and doing more to minimise the environmental impact of their organisation (22%).

I believe, broadly speaking, that consumers want to make better choices but the lack of awareness, lack of alternatives and perhaps a view that the onus should be on the retailer – not the consumer – to fund this shift is hindering progress. Consumers may think of themselves as altruistic – but at the sake of convenience? I don’t think so. Retailers need to become more transparent and ultimately provide consumers with compelling incentives to alter their shopping habits.

Perhaps we will only see meaningful change with regulation, but as a starting point retailers should be prioritising operational efficiencies that allow them to simultaneously progress the sustainability agenda. After all, financial and environmental sustainability often go hand in hand.

Download the full whitepaper.

Listen to Natalie Berg and Ben Sillitoe, Editor of Green Retail World, discuss the findings on the Retail Disrupted podcast.