Falling consumer demand combined with a barrage of rising costs is set to create a challenging six months ahead for the retail sector – according to the latest assessment by KPMG/RetailNext Retail Think Tank (RTT) members.

With early indications of a disappointing Christmas trading period for some retailers, particularly in non-food categories, and food retailers resorting to increasing the level of promotions in order to drive sales this year, there will be very little respite for the retail sector as it enters 2024, according to the latest KPMG/RetailNext Retail Health Index (RHI).

Setting the scene for the challenges that lie ahead, the RHI, which assesses the state of health of the UK retail sector by considering the three key drivers of demand, margin, and cost, concluded that beleaguered consumers will hit the pause button on spending even further in the opening months of 2024. Despite having more money in their pockets than they did in Q1 23 due to reductions in National Insurance Contributions, wage growth outstripping inflation and lower fuel bills which has helped to boost household income slightly year on year, consumer sentiment is likely to remain low as the mood music around an ailing economy impacts their willingness to spend, the RTT concluded.

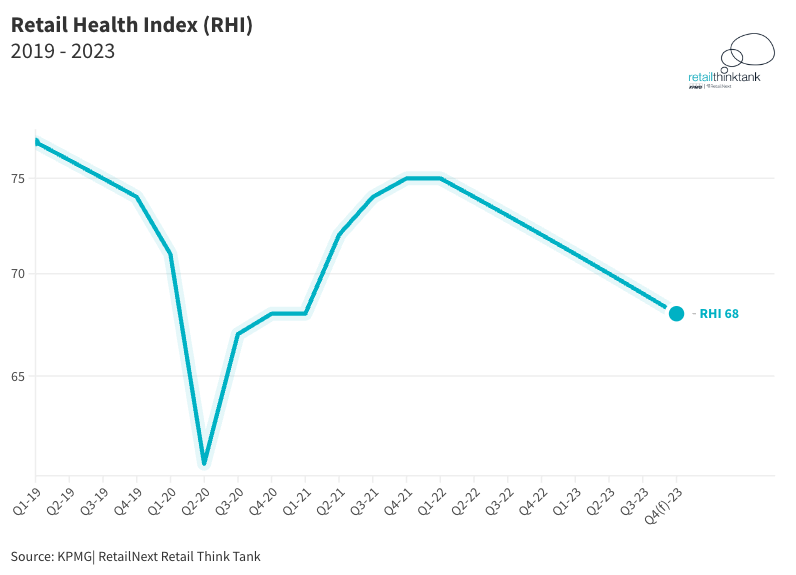

The RHI has recorded a deterioration of retail health every quarter since Spring 2022 and this is predicted to continue in the first half of 2024, hitting 66 points by the close of Q1 24, a figure last seen in the height of the pandemic in 2020 when the UK was in lockdown. While the opening months of 2024 are likely to see a continued downturn in consumer demand, especially in non-food categories, it is just the calm before the storm as Q2 24 will see the sector hit by rising costs, including a hike in the minimum wage and a 6.7% business rate increase for most retailers. While demand is likely to pick up in Spring 2024 (Q2 24) as consumer confidence builds, rising costs will hit retailers, particularly those whose finances are not stabilised RTT members concluded, signaling potentially higher insolvency rates for small retailers and a boost in M&A activity – particularly in fashion and pure online retail, where there will be pressure on consolidation.

Highlights from the KPMG/RetailNext Retail Health Index included :

- With household financial assets outweighing financial liabilities by £4 billion, the ability to spend will be polarised between households.

- Savers enjoying higher interest rates are unlikely to be tempted to spend savings in early 2024.

- Health and beauty are expected to be the only non-food category to see growth in the opening months of 2024.

- Luxury retail and big-ticket categories will continue to experience a downturn in sales.

- Sales growth for the big supermarkets in 2024 is likely to be more subdued, with the boost from grocery price inflation dropping away and pressure on volumes continuing.

- Growth in 2024 will come from the discount and value retail channels.

- London retailers face a ‘double whammy’ of rising business rates given the bulk of London’s retailers are multiples, and the fact that business rates in London are significantly higher than in the rest of the UK.

- Further promotional activity is expected as retailers look to clear down excess stock and react to falling consumer demand.

Commenting on the RHI, Paul Martin, UK Head of Retail at KPMG, said:

“Despite Black Friday sales going deeper and lasting longer than last year, indicators so far are that Christmas trading this year has been one of the worst since the pandemic hit, and although there is still all to play for in the final weeks of December, it is looking as if it’s too late turn fortunes around. Whilst food retailing sales growth has been weaker than seen over Christmas last year, sales of non-essential goods have been deteriorating rapidly and will continue to do so as consumers keep an even tighter grip on the household purse strings.

“It has taken a long time for the economic challenges to feed through to consumer resilience, but it looks as if it’s happening now, and is set to stay with us, at least until spring. The UK retail sector will likely continue to see significant downward pressures on demand, and margin, for the early part of 2024 but this could turn a corner by April, just as hefty increases in minimum wage and business rates hit the bottom line. Retailers will be holding their breath for some good news in the Chancellor’s Budget in March.

“Retailers have been remarkably resilient over the last few years and are now well versed in being agile to cope with economic shocks and changing consumer demands. Pressures on consumers from high inflation may be easing, but the economy faces headwinds from the lagged impact of monetary policy tightening and rigid fiscal policy settings. For the next few months, we expect the retail sector to continue to tread water as it moves from dealing with one shock to another.”

What the RTT members said:

Jonathan De Mello, Founder & CEO, JDM Retail Ltd:

“Moving into 2024, with residential rents continuing to increase, more and more fixed-rate mortgages running out and inflation staying relatively high, the first two quarters of 2024 at least will likely see lower consumer demand and a concurrent impact on retail sales and margins.”

James Sawley, Head of Retail & Leisure, HSBC UK:

“We’ll see less distress in 2024, as many small businesses gave into the conditions of 2023, characterised by high inventory levels (low cash), peak inflation, peak energy cost and the rising cost of capital. We now have normalised inventory, low freight costs, falling inflation, and a clearer idea of where interest rates are settling, as well as an extension in business rates relief. We are likely to see consolidation in some segments of the sector where high costs, intense competition, and softening of demand will make it a compelling or necessary move”.

Nick Bubb, Retailing Consultant, Bubb Retail Consultancy Ltd:

“Q4 23 saw a lacklustre performance with volume pressure in non-food categories and the real sense that consumers are tightening their belts. Whilst a lot depends on what we see happen over the next few weeks, there has already been a lot of discounting and this is likely to continue after Christmas as well. As for the outlook for the retail sector in general, much will depend on when the Bank of England feels able to start to lower interest rates, to relieve the pressure on “big ticket” spending, although this is unlikely to be before the second half of 2024.”

Maureen Hinton, Retail Consultant:

“With costs rising and consumers remaining selective in their spending, retailers will need to deliver compelling offers, backed by strong finances, to succeed in 2024.”

Mike Watkins, Head of Retailer and Business InsightNIQ UK:

“After two years of falling volumes in food retailing, there is likely to be a return to volume growth in 2024. For many supermarkets, the quest to gain shopper loyalty – frequency of visits and total shopper spend – will intensify. The extension of loyalty schemes has helped pull back some spend lost to discounters. NIQ research shows that 54% of shoppers said that price discounts via loyalty cards were the promotional mechanic most likely to encourage them to spend with everyday low prices a close second (34%). This reinforces the need for the supermarkets to maintain transparent price strategies, price locks, and price matching.”

Miya Knights, Retail Technology Magazine, Publisher and Consultant:

“With stagnant demand, 2024 will be a year of two halves in terms of retail health. Competition is fierce and retailers will need a differentiator. Technology investments will continue to help separate retail winners from losers throughout the year, just as it has increasingly done for over 25 years now, and at an accelerated pace ever since the pandemic. However, where it may have previously been enough to adopt and deploy technologies that allowed operators to catch up to their competitors, those who genuinely innovate using IT and digital will succeed next year.”

Natalie Berg, Retail Analyst and Founder of NBK Retail:

“As we look ahead to 2024, it’s worth calling out that whatever is thrown at retailers, they will be far better equipped to handle it than they might have been just a few short years ago. I wouldn’t suggest that 2024 will be uneventful, but I think retailers can certainly welcome more stability. The worst of the cost-of-living crisis is behind us, and although consumers have been surprisingly resilient thus far, we’re certainly not out of the woods just yet. Consumers will continue to exercise caution and restraint, leaving retailers to contend with somewhat muted demand, heightened expectations and cost pressures of their own – from business rates to hefty increases in minimum wage requirements from April 2024.”

Charles Burton, Director, Oxford Economics:

“Despite further falls in inflation and, from the middle of the year, the Bank of England potentially starting to reduce interest rates, we expect the UK economy will struggle to gain momentum in 2024. Household spending generally will only grow slowly, and likewise retail sales. There will be some variation across the UK, with the south (London, South East and South West) performing better than average, with the Midlands, North East, and Scotland faring less well. This is very much a reflection of job losses in the industrial sectors feeding into overall regional performance.”