This week I’ve taken part in the Retail Week Tech Race. Using only chip and pin, I had to spend as little as possible on: a home assistant, Asos branded clothing, 500 penny sweets, original Nintendo Game Boy, personalised item, £5 scratch card and a build your own robot arm.

The aim of the race was to demonstrate the importance of payments as a frictionless part of the customer experience.

My opponents:

- Team Cash – George MacDonald, Executive Editor, Retail Week

- Team Contactless – Andrew Busby, Founder & CEO, Retail Reflections

- Team Crypto – Peter McCormack, Cryptocurrency Trader, Miner, Blogger and Advisor, What Bitcoin Did

- Team Mobile – Rachel Arthur, Chief Intelligence Officer at The Current Daily

Team Chip and Pin: Key takeaways

1) Shopping habits have evolved, payments not so much.

My initial reaction to being assigned chip and pin? NO. ONLINE. SHOPPING.

That alone was going to be a challenge for me. And that’s not because I don’t shop in stores, but when faced with a long list of disparate items – some of which are near impossible to find in a bricks & mortar shop – my first instinct is to get online.

Having to physically trek around individual stores (in 32 degree heat no less) in the hope of some very specific items being in stock was a stark reminder of just how spoiled for choice we are today. We have access to millions of products right at our fingertips – and they turn up on our doorsteps the same or next day!

Even if I attempted to use click & collect, I would have had to pay for the item online which ruled out using chip and pin. Argos was an exception here, so reserve and collect (ie. pay at the store) came in handy. I even resorted to calling a few stores to see if items were in stock – very 2003!

2) With low-value items, cash is still king.

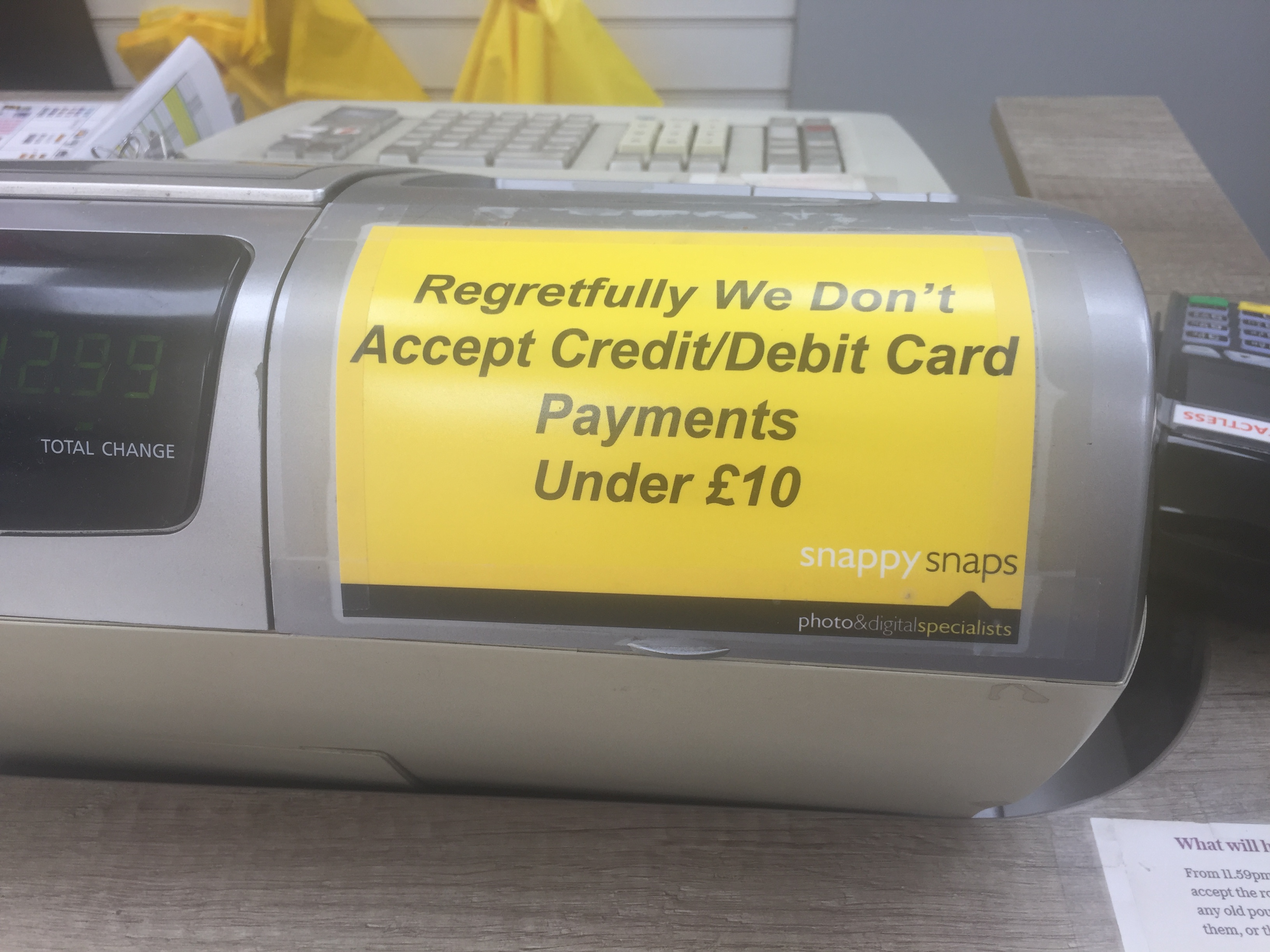

Bearing in mind that the goal was not only to source all items on the list but to do it as cheaply as possible, I ran into some issues when trying to purchase low-value items like the £5 scratch card and personalised item. Retailers would charge an additional (50p) fee or simply wouldn’t accept card payment. It was a reminder that, in some instances, cash is still king.

3) Less choice on the high street further limited my options with chip and pin.

This year’s high-profile collapses of Maplin and Toys R Us made it more difficult to source some of the more peculiar items on the list – ie. build your own robot arm. The superstores I visited also, unsurprisingly, had a much-reduced electronics section as this category has largely shifted online.

This year’s high-profile collapses of Maplin and Toys R Us made it more difficult to source some of the more peculiar items on the list – ie. build your own robot arm. The superstores I visited also, unsurprisingly, had a much-reduced electronics section as this category has largely shifted online.

In the end, I managed to purchase 5 out of 7 items on the list using chip and pin – all but the Asos-branded item of clothing and original Nintendo Game Boy. It was only at the very end that I had a lightbulb moment – I could have saved myself a ton of time and energy by using Amazon Top Up!

Main takeaway of the race? Consumers demand to be able to shop on their own terms and they expect that experience to be completely and utterly seamless. But when it comes to payments, there’s still a whole lot of friction.

You can hear all about the #RWTechRace in our session at the Retail Week Tech conference, 12-13 September, and for video updates of the race check out the NBK Retail YouTube channel.

https://www.youtube.com/watch?v=P1P4TLdtOcU